Setting Your Pastor’s Salary Package

Every fall, the Executive Leadership Team sets the suggested pastor’s compensation formula for the coming year. The formula includes a Standard Base Salary.

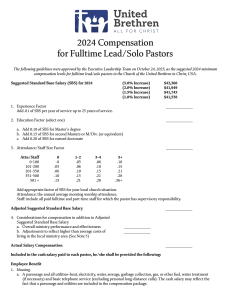

View the 2024 Guidelines for Fulltime/Lead Solo Pastors

The Standard Base Salary is only the starting point of the fulltime salary package. The complete recommendation also includes benefits, reimbursement, and other factors.

Some churches assume that if they meet the Suggested Standard Base Salary, their pastor is fulltime. Wrong, wrong, wrong. The minimum fulltime salary includes that base amount, plus additional compensation depending on:

- Years of service.

- Education level.

- The church’s average attendance.

- Staff size.

Plus these benefits:

- Housing allowance.

- Utilities.

- Medical and disability insurance.

- SECA and pension.

- Vacation.

If a church doesn’t meet the criteria in full (the base salary plus the additional factors plus the benefits):

- The pastor is not considered fulltime.

- The pastor may pursue supplemental employment to achieve this compensation level.

And this is only the minimum. The hope is that churches would exceed these guidelines for their pastor.

The Pastor Compensation report gives all of the information needed to set your pastor’s salary. The links on the right will enable you to download the report in PDF and Word formats.